What just happened? Investors are pumping money into quantum computing firms at an accelerated rate in hopes of a big payday down the road. According to financial research firm PitchBook, outfits that deal in quantum computer hardware and software have brought in nearly $1.02 billion from venture capitalists this year alone. That's up from $684 million generated in 2020 and just $188 million in 2019, and doesn't even count a recent development in the industry.

Berkeley-based Rigetti Computing recently announced plans to merge with special purpose acquisition company Supernova II as part of a transaction valued at $1.5 billion. Once closed, Rigetti Computing will go public on the New York Stock Exchange under the ticker symbol "RGTI."

Before the Rigetti deal, the previous largest deal in the sector was a $450 million investment led by BlackRock back in July into PsiQuantum, valuing the tech company at $3.15 billion.

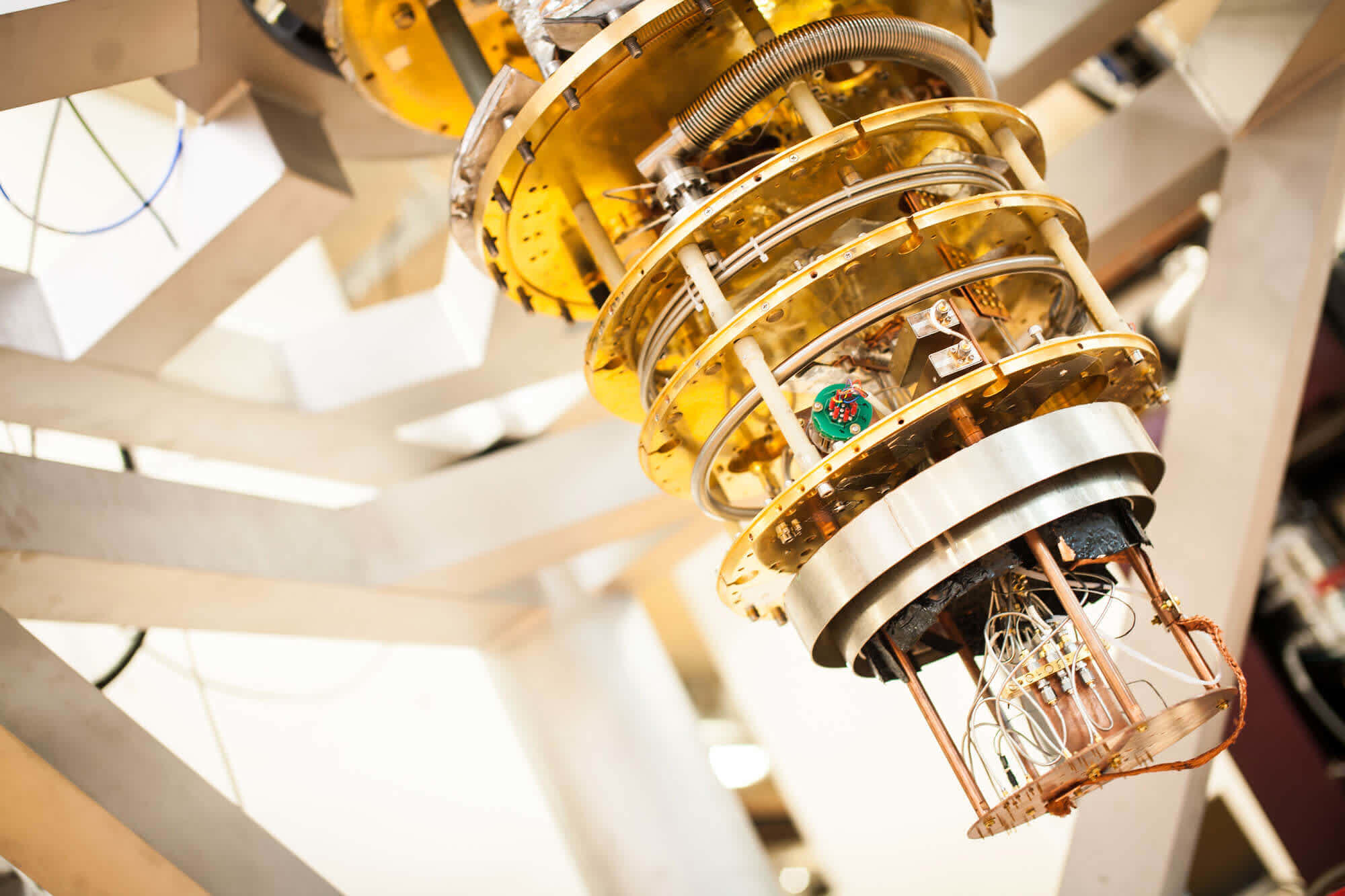

Plenty of major players are already involved in the world of quantum computing including Microsoft, Google, Intel and IBM, among others. Yet even still, we've just barely scratched the surface of what could be possible with quantum computing.

In the simplest of explanations, classical computers operate using one of two states: off or on (0 or 1). Quantum computers harness the phenomena of quantum mechanics, where states are no longer binary and can be 0 and 1 at the same time.

For a better primer, be sure to check out our feature on quantum computing from a few months back.