WOMEN IN TECH

WOMEN IN TECH

WOMEN IN TECH

WOMEN IN TECH

WOMEN IN TECH

WOMEN IN TECH

In a year when venture capital funding broke records, investment in women-led startups has dropped. Why are investors passing up these opportunities, and can the digital landscape navigate a new narrative for female entrepreneurs?

To answer these questions, SiliconANGLE looks into the continued gender disparity in VC funding in the world of cloud computing, with special commentary from investor and advisor Shelly Kapoor Collins, founder of the Shatter Fund Inc., and equality and environmental activist Tara Gupta, founder and chief executive officer of Map-Collective Inc.

As traditional companies make the move into the digital economy, they rely on cloud native startups to provide the products they need to make the transition. Yet, half of the innovation ecosystem is being ignored as women-led and minority startups go unfunded.

The inequality has a direct impact on business. Potentially revolutionary products have been denied the opportunity to go to market, as minority-led projects struggle and die due to lack of funding. Why?

An answer can be found in the statistics that 82% of venture capitalists are male, nearly 60% white male, and 40% attended either Stanford or Harvard — facts that made survey author and general partner at Equal Ventures Richard Kerby comment: “It is no wonder that this industry feels so insular and less of meritocracy but more of a mirrortocracy.”

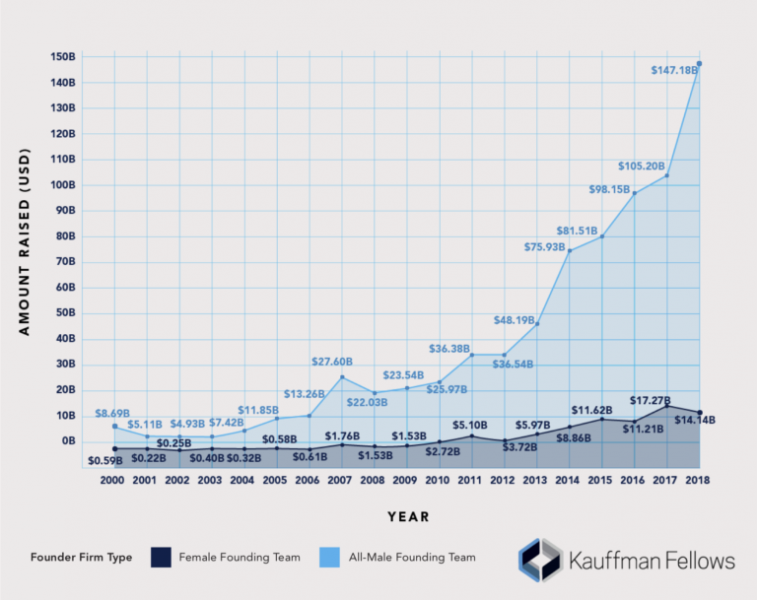

Image: Kaufmann Fellows

The reason for the gender-investment gap runs parallel to the gender gap: It’s a human trait to trust and want to invest in people and projects that match our own culture and experience, explained Kapoor Collins, who has spent her entire career working for diversity in the VC industry. This has created a vicious cycle of funding.

“When the storied VC firms in Silicon Valley were founded, they were founded by non-diverse teams — white men — and there’s a phenomenon where people who look like each other give to each other, they raise from each other. They then narrow down their networks to include only like-minded people,” Kapoor Collins told SiliconANGLE. “The industry became more and more insular where there were only men raising from each other and investing in each other.”

This non-diverse industry has led to a majority belief that funding white, male entrepreneurs is a good thing. Enforcing this “like invests in like” justification for the lack of funding given to minority startups, the Mass Challenge/BCG survey found that while over 80% of female and multicultural VCs believe that maximizing returns and intentionally investing in women and multicultural entrepreneurs are compatible goals, only 59% of traditional venture capitalists believe the same.

A Mass Challenge/BCG survey found that companies founded or co-founded by women receive less than half the funding of companies founded by male entrepreneurs yet generate more cumulative revenue.

We asked Kapoor Collins if she could explain this statistic.

“When there is a diverse point of view and where a diverse team is at the helm of a company, and you have that diverse point of view that goes into the solution that’s being designed for the consumer, you are just automatically going to generate a greater return by casting a greater net of consumers. You’re capturing more consumers because you’re addressing more of their needs,” she said.

Image: Shelly Kapoor Collins

Women account for 85% of all consumer spending in the U.S. That’s a lot of purchasing power. But it’s a market that male VCs often overlook because they do not see the value in products and services designed for women, and therefore don’t invest in them.

“When there is a woman at the helm of a company, she is designing the product for the female consumer. And when that happens, they’re more likely to buy it,” stated Kapoor Collins, who added that women are also more capital-conscious.

“Because they need less capital upfront, women-led and founded companies tend to exit at least one year faster,” she said, citing the Morgan Stanley research that claims that by not investing in women-led and founded companies, investors are leaving $4 trillion in returns on the table. “Women-led and founded companies are just a better return on investment and investment opportunity for investors.”

Women are also more likely to take a communal approach to founding and running a company, creating a more nurturing atmosphere. This is due to societal expectations but is a benefit, according to Gupta.

“The way that we give feedback is not ‘I give an order, and it is final. It’s more ‘I’m going to encourage you in a way that creates intrinsic motivation,’” she said, describing how she manages her employees at Map-Collective.

You have to define a new model or a new archetype — Tara Gupta

But this difference in vision and management style means that female-led companies can follow a less traditional growth pattern. While Gupta is focused on financial success, her companies are built with a more long-term vision than hitting unicorn status.

“It’s about not just achieving an exponential growth pattern, but also at some point leveling out as an S-curve and making sure that becomes a sustainable organization,” she said.

However, not fitting the expected mold has been one of the barriers to getting funded, according to Gupta.

“If you suggest that you’re not exactly that type of unicorn that they’re looking for, you might still be a rocket that needs that type of rocket fuel, but they might not be able to relate to that just because you aren’t defined in a model,” she said.

Instead of changing her vision or partnering with a white male to fit the success stereotype, Gupta chose to fund her company herself.

“I ended up just going the bootstrapping route and being happy and secure that I own 100% of my company,” she said, recommending that other women consider the route. “You have to define a new model or a new archetype. You’re not looking to be that sole entrepreneur that is the genius behind everything that is going right in the world. You are actually changing the narrative.”

Image: Tara Gupta

A millennial Indian-American who is proud to identify as LGBTQ+, Gupta has hit many roadblocks in her search for funding. At first, she struggled to make sense of why her male peers raised funds easily while she was continually turned down. Then she realized that it wasn’t her business model; it was because of her identity.

“There’s the whole problem of de-facto racism that’s going on,” she stated. “I ended up raising, not raising, raising, not raising, because so many deals fell through. So many people were like, ‘Oh yeah, we’re interested,’ and then it just didn’t get to that next point even though we have all the ingredients.”

The research proves that women of color face a double challenge when seeking funding. White entrepreneurs receive three times more startup capital than their black counterparts, according to a Stanford Institute for Economic Policy Research report, and digitalundivided’s ProjectDiane found that U.S. companies fronted by Black and Latinx women received just 0.64% of the total venture capital funding available.

Female entrepreneurs such as Gupta and investment companies such as the Shatter Fund are actively working to change the paradigm and increase the funding stream to female and minority-led entrepreneurs. While they are making a difference, an industry with such an embedded diversity problem is not going to suddenly become equitable.

In 2016, 5.7% of decision-makers in U.S. VC firms were female, according to research by Axios Media Inc. This increased to 7% in 2017, 8.93% in 2018, and 9.65% in 2019. It is an upward trend, but it is still only around one woman for every 10 men. And as the ‘like-invest-in-like’ paradigm proves, funding isn’t going to be given to more diverse founders until there are more diverse VCs.

“It’s a pipeline issue,” Kapoor Collins said. “We need women at the very onset to be a part, to have an understanding of STEM, to have an understanding of entrepreneurship and education in entrepreneurship.”

When women are engaged in their community from a policy level, they give back most and they invest in their communities. — Shelly Kappor Collins

Breaking the like-invests-in-like cycle is a battle Kapoor Collins, Gupta, and hundreds of women entrepreneurs and venture capitalists like them are fighting daily. It is part of the greater fight for female equality in the workforce across all sectors. A battle that, if won, would bring greater prosperity to everyone, according to Kapoor Collins.

“[When women are] 100% engaged in the workforce, our GDPs go up; when women are engaged in their community from a policy level, they give back most and they invest in their communities,” she said.

Women and minority-led businesses are more likely to hire more women and minorities, flipping the mirrortocracy image from negative to positive.

Ending the venture capital gender-gap reaches further than investment equality or returns. It is essential to create a vibrant innovation ecosystem and provide diverse solutions for future markets.

“The return on investment is one thing, but the need to bring more women into the workforce is undervalued,” Kapoor Collins said. “One hundred percent it’s a double bottom line, no doubt about it.”

THANK YOU